Greed and Desire for Profit

In stock market every person wants to double the money that he has and this greed and desire for money making in quick way he gets scammed by many scammers. In this post you will know How Scammers Use Retailers Strong Emotions to make retailers fools. Lately when he know he is in scams then there are many loses with a retailer.

“The Dark Side of Emotion: How Scammers Target Retailers”

When a new retailer come into the market, he got a disease of FOMO ( Fear Of Missing Out). He does not know any set of rule no watchlist everything is in air. Scammers use this weakness of retailers. Scammer takes information of persons from telecommunications companies and other application which use information of our cellphone and also brokers app. Which person is interested in stock market, after taking your mobile number they start following you.

1. Emotional Triggers in the Stock Market

Desperation: During market downturns, retail investors may be more susceptible to scams that offer quick recovery solutions. Scammers prey on the desperation of those looking to recover losses rapidly.

Fear of Missing Out (FOMO): Scammers often create a sense of urgency, pushing retail investors to buy into stocks that are hyped as “the next big thing.” This can lead to impulsive decisions based on fear of missing out on potential gains.

Greed: Promises of high returns in a short period can appeal to retail investors’ greed. Scammers might promote “pump and dump” schemes where they artificially inflate the price of a stock, only to sell off their shares at the peak, leaving retail investors with worthless stock.

2. Common Scams Targeting Retail Investors

- Pump and Dump Schemes: Scammers spread false or misleading information to inflate the price of a stock they own, creating a buying frenzy. Once the price is high, they sell off their shares, leaving retail investors with devalued stocks. They give you undervalued stocks for buy and selling.

- Boiler Room Scams: High-pressure sales tactics are used by scammers to sell worthless or overvalued stocks. Retail investors are emotionally manipulated into making quick decisions without proper research.

- Advance Fee Scams: Retail investors are promised high returns on certain investments but are required to pay an upfront fee. Once the fee is paid, the scammers disappear, and the promised returns never materialize.

Scammers’ Tactics: Leveraging Retailers’ Emotions for Fraud

The Emotional Landscape of Retail

Retailers operate in an environment where emotions run high—whether it’s the excitement of a big sale, the stress of meeting monthly targets, or the anxiety of navigating economic uncertainties. Scammers know that these emotional states can cloud judgment, making retailers more susceptible to fraud. By tapping into these emotions, scammers craft scenarios that seem urgent, legitimate, and often too good to pass up.

Exploiting Greed with Too-Good-To-Be-True Offers

Scammers also exploit the desire for profit by offering deals that seem too good to be true. Retailers might receive an unsolicited proposal for bulk products at heavily discounted prices, or an opportunity to invest in a new product line with promises of high returns. Driven by the prospect of boosting profits, some retailers may rush into agreements without performing due diligence, only to discover that the offers were fraudulent.

In one notable case, a retailer was approached by a company claiming to have excess stock of high-demand electronics at a fraction of the market price. Eager to capitalize on the opportunity, the retailer transferred a significant amount of money for the goods, which never arrived. The “company” disappeared, leaving the retailer out of pocket and without any recourse.

Statistics on Stock Market Scams

- Increase in Scams: The U.S. Securities and Exchange Commission (SEC) reported a 40% increase in stock market scams targeting retail investors during the COVID-19 pandemic, as more people turned to online trading platforms.

- Pump and Dump Losses: A study by the SEC revealed that retail investors lost an estimated $10 billion annually due to pump and dump schemes.

- Cyber Fraud: According to the North American Securities Administrators Association (NASAA), 50% of retail investors surveyed were targeted by some form of cyber fraud related to the stock market in the past year.

Case Studies and Real-Life Examples

- Example 1: In 2021, a popular stock trading app saw a surge in retail investor activity around a particular stock due to online hype. It was later discovered that a group of scammers had orchestrated the pump and dump scheme, leaving thousands of retail investors with significant losses.

- Example 2: A boiler room operation in New York was shut down after it was found to have defrauded retail investors out of millions of dollars by using high-pressure tactics to sell shares of a non-existent company.

Impact on Retail Investors

- Financial Losses: Retail investors can suffer significant financial losses when they fall victim to stock market scams. According to the Financial Industry Regulatory Authority (FINRA), the average loss per victim in stock market scams is around $30,000.

- Erosion of Trust: Being scammed can lead to a loss of trust in the stock market, making retail investors wary of future investments. This can result in reduced market participation, which has broader implications for market liquidity and efficiency.

- Emotional Toll: The emotional impact of being scammed, such as stress, anxiety, and loss of confidence, can have long-lasting effects on retail investors’ financial behavior and overall well-being.

Here i share how they do this..

I am posting this post on 14 August 2024. I was joined in a group where undervalued stocks given to retailers for sell & purchase. They give stocks today and sell them tomorrow and you will get 10-20 % return.

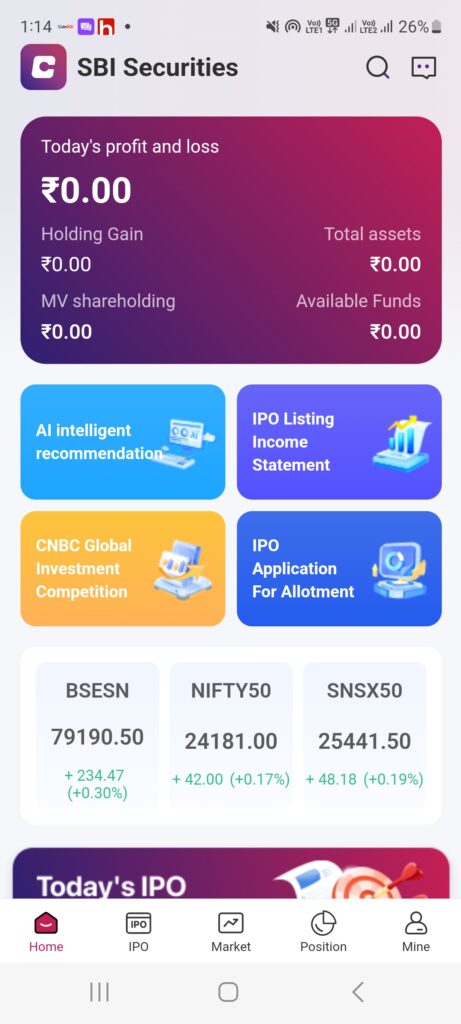

They provide IPO information’s and give prediction how much money you can earn from IPO ( IPO return). There is a voting system thay said our professors are represents india in international trading competition challenge. Vote for our professors we will give you prize pool 3000 INR PER WEEK. They joined me and i voted for them they give me 3000 inr.

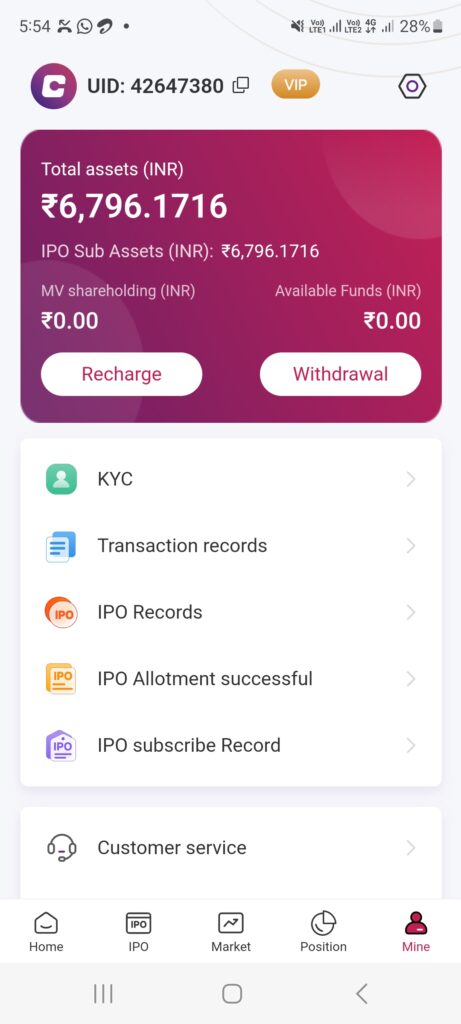

Now Scam start they give me advice if you have a fund add in our app you will get IPO and Double the money. I said i not have money they give me advice that take LOANS from Banks and put in our app. I add 5000 INR just for checking now 6000 i received and 5000 i deposited and some profit total is 16000 inr. They suggest me apply IPO just only I apply IPO than i want to for my money withdrawal 16000 inr, they blocked my fund that You get successfully .

And IPO value is 116000 at this fund can any broker provide IPO when i have 16000 in my broker account ,NO, They provide me IPO allocation. And now asking me to add remaining fund in app for IPO Allocation.

When any person withdraw her money they removed that person from every group. So be carefull for your hard money ,never be fooled in emotional.

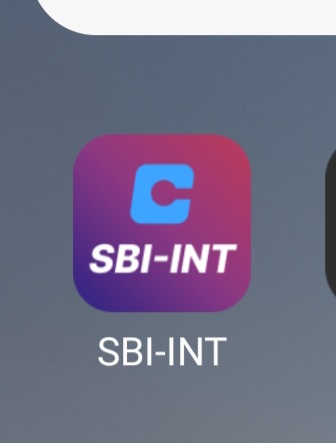

SCAM APPLICATION NAME IS –>SBI-INT ( SBI Securities)

I upload image of the app . This app is not on PlayStore or any other platform. they send link for downloading. They change everytime application name but motive is only one FRAUD WITH RETAILERS.

How Scammers Use Retailers Strong Emotions