The main importance of supply & demand zone trading is that these zones show the pending orders of institutional traders and big banks. This strategy is very simple you have to only findout these big traders pending orders on chart using. demand and supply patterns.

If you want to be master in trading than pick one strategy not more than one or two. For getting rich you only need to master in one skill. 90% retail traders are fail because they don’t know when to enter when to exit they don’t follow professional trader.

In simple terms, supply and demand trading is the method to follow the banks and big traders. About 94% of the forex market is traded by the central banks, hedge funds, and institutions. The rest of the 6% is the retail traders. So that’s why if you want to make a profit, you should try to predict the movement of these market makers. If you trade like a retail trader with emotions, you will lose in this market.

The second important thing is that the basis of the supply and demand zones is the price action. Because price repeats the above four price patterns after irregular time intervals on the candlestick chart, this is a price action strategy. There is a science in market where professionals wants to move the market, market moves in thier direction. Follow professional because they follow rule they place orders and wait for price to come in thier zone. Professional don’t modify entry price and stoploss. So become a great trader follow them.

What is the difference between fundamental and technical analysis of supply-demand in trading?

There is a significant difference between these two analyses.Price always moves due to the difference in supply and demand of a certain currency or asset. For example, if more buyers are willing to buy the dollar, then the dollar demand will increase. This increase in demand is directly proportional to the rise in the US dollar price. On the other hand, if more sellers are willing to sell dollars, the supply of dollars will increase. This will result in a decreased price of the dollar.

The method or news that informs us about the demand of the dollar or supply of the dollar in the market is fundamental analysis.

Now let’s come to the main point: the supply and demand in technical analysis.In technical analysis,

we draw the zones on the price chart using the natural price. There is no more complex any technical analysis. We have to just find out Demand zone below Current market price and supply zone above Current Market Price.

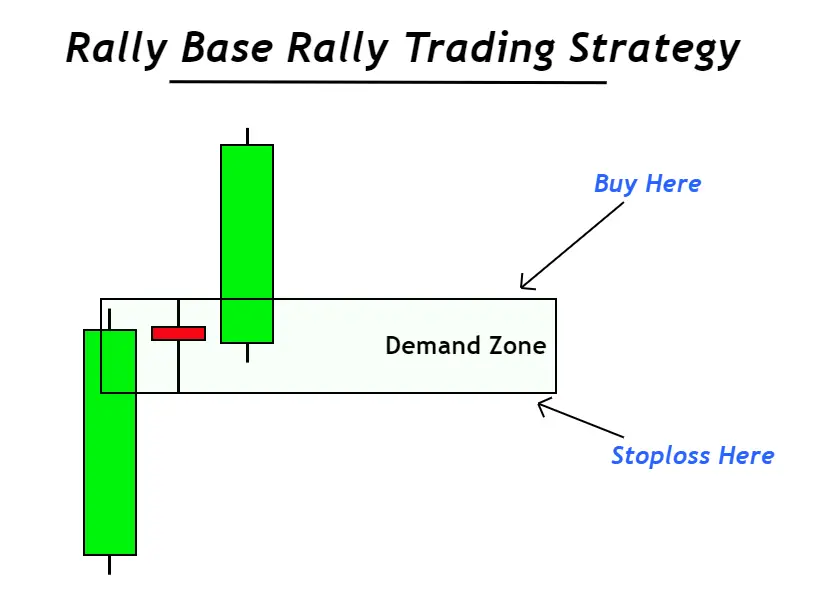

The rally base rally and drop base drop show the phenomenon of compression and rarefactions on the price chart.

I hope you’ll understand this difference. If you’ve not made it yet, then keep on reading.

How to Trade Supply and Demand Zones

we would always be buying low and selling high — buying at demand zones and selling at supply zones. Therefore, we will be buying against the direction the price is moving, because we have a good estimation for when the price is about to reverse. Once findout the demand zone pattern on chart.

Entry price will be unfilled order candle upper wick and stoploss will be at pattern base.

Limit Orders – Set and Forget Method

Supply and demand trading is based on the predefined price. This is the beauty and the power of trading SD. It provides, with high probability and accuracy, the location where the price will be reacting in the future.

With this information, it would be very simple to set pending orders to be automatically triggered once the price hits a future price level. This allows us to set up trades using limit orders, and let the market develop at its own pace. You can wait in comfort for your trades to be triggered, whenever it happens, with no further effort.

After find demand zone pattern use Bracket order. Bracket order contains–Entry point, Stoploss, Target price. Demand & Supply zone trading is all about to find zone and set target and enjoy. You not need to sit in front of screen 9 am to 3:30 pm.

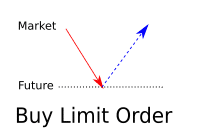

Since you know all the key parameters for the trade. you can simply set up limit orders and specify the entry, stop loss and take-profit.Buy Limit Orders supply and demand

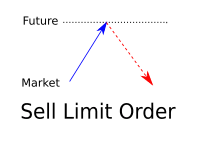

Sell Limit Orders

Similarly to the buy limit order, you can set up a limit order to automatically enter a sell market order when the price re-enters the demand zone.To sum it up, look for a price move that speeds away travel far away and stays away for a long time. When the price arrives back to the original level, the odds are high that it will go back up again.

Supply and Demand Forex Conclusion

The Supply and Demand trading technique, using support and resistance levels, has great advantages. It can be traded as “set and forget” with pending orders. You know all the trade values ahead of time (entry, stop loss, take-profit) and it provides a great RRR (return-risk ratio).

However, like all techniques, it must be practiced and mastered. There are many caveats to be aware of. It takes time to learn how to handle them all. We advise you to learn more and understand that it is not quite as simplistic as it seems, nor is it a pure systematic trading strategy. It requires deeper learning.