This article we will explore the IntraDay Stretegy For 2% Return and how you can potentially use it to boost your profits. So, fasten your seatbelt and prepare for an exciting journey into the world of open high-low trading.

Key Open High-Low Trading Terminologies

Let’s first get a good grasp of some essential trading terminologies before delving into the Open High Low Strategy and its significance in the intraday trading market.How can enter and exit from trade, we will discuss all terminology in this article.

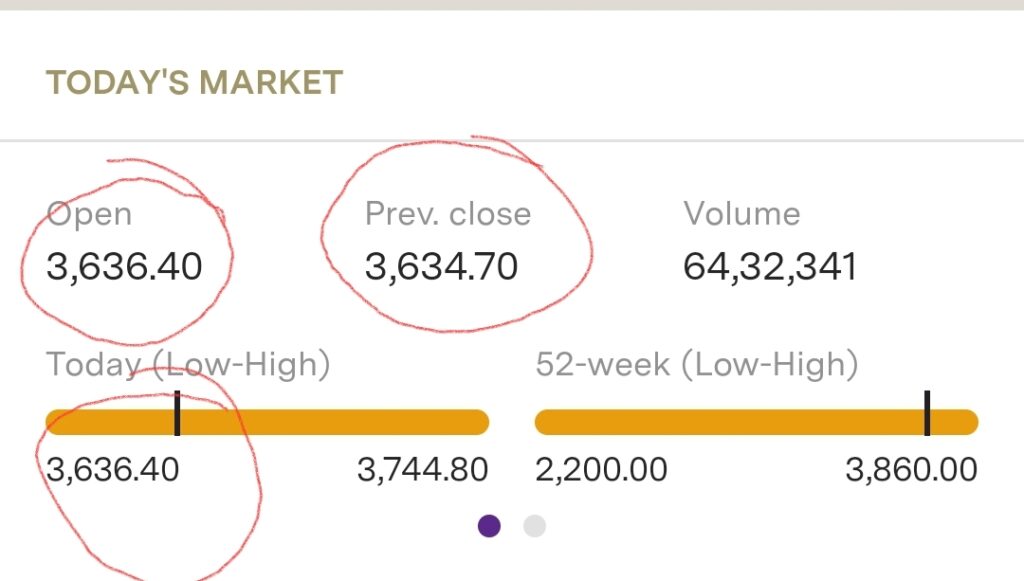

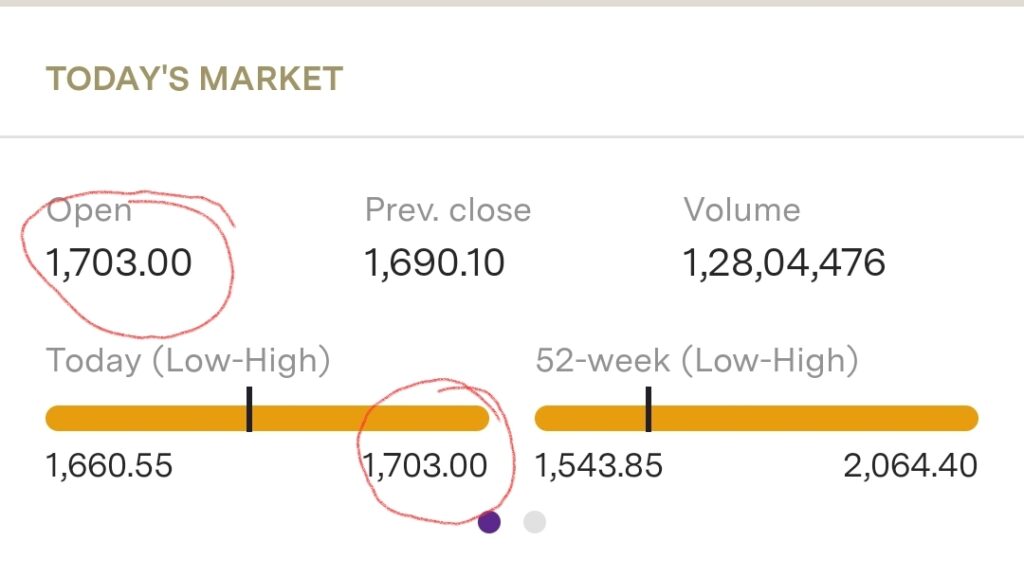

Open: The term “open” refers to the price at which the very first trade of a stock is made for the day. The open price is a crucial indicator of the stock’s performance for the rest of the day. This value is significant as it reflects any information changes between the previous day’s last trade and the last order placement before the market opens.

High Price-High price refers to when stock price is open to high price and this opening price is highest price for the day means open=high price.

Low Price-Low price of day is the price when stock opening price is equal to low for the day called low price.

What is the open high, open low strategy?

The Open High Low (OHL) strategy is a popular technique traders use in the stock market. It’s a simple yet effective approach where a buying signal is generated when a stock’s open price is the same as its low price. Conversely, a selling signal is generated when the open price is the same as the high price. The goal is to identify trends and patterns in the stock market and make trading decisions accordingly.

OHL trading is a form of intraday trading where all positions are balanced off before the market closes. This ensures no change in the ownership of shares due to trades. It’s a game that requires knowledge and skills in finance, news analysis, and risk management.

The original name of the OHL strategy was open dive, which accurately reflects the risks and rewards involved. The approach used in the OHL strategy is to buy stocks when the open and low prices are the same and to sell stocks when the open and high prices are the same. While this technique can make you rich, it can also lead to losses if not executed properly.

However, the OHL strategy is not as simple as it sounds. The NIFTY 50 Index identifies the best sectors to invest in and pulls stocks out of the market at the right time. Some scanners help interpret stock prices with greater accuracy. The Open High Low Scan is a method used to process scripts that are open=high or open=low. You can use online calculators to find thresholds for buying or selling and filter out scripts suitable for intraday trading.

Generally, the trading volume in the market is high in the first 15 minutes, leading to more favourable trading opportunities. Such opportunities arise owing to the increased trading volume and price range expansion.

For instance, if the value is the same for open as well as low of the day, it serves as an indication that there’s excess demand in the market, which in turn leads to higher stock prices. That said, the reverse will hold true if the value is identical for open and high. In other words, there will be excess supply in the market. Accordingly, stock prices will be lower.

Intraday traders opting for the open high low strategy must give more emphasis on the opening trading session as that’s when they have high chances of maximising their returns.

How take Entry in this Strategy –

1.Open-low, Open-high strategy works for intraday. Before taking entry you have to decide your risk reward.

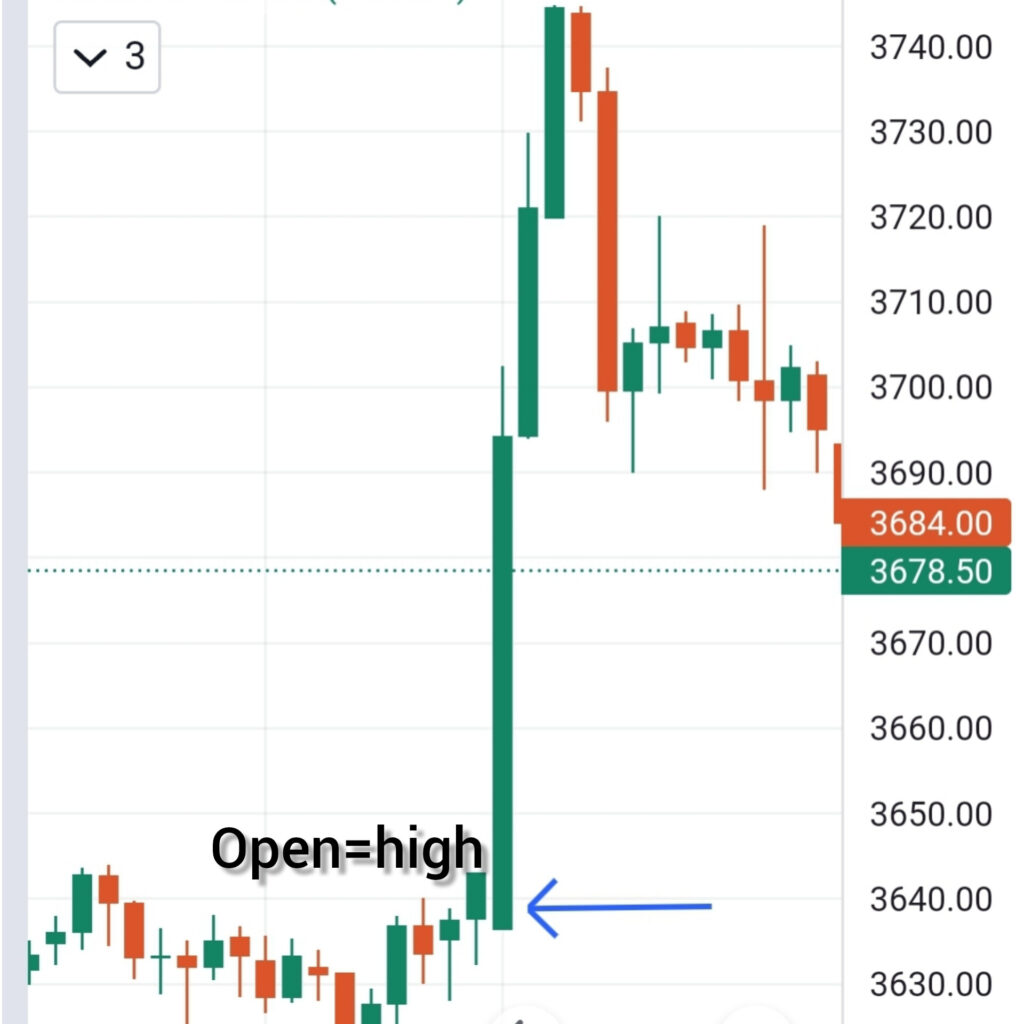

2. Use 10 minute chart time frame or 15 minute.

3.Identity trend and pulse of stock, and mark the last day closing price on daily chart or 4hr.

4.If trend up and pulse positive. Than if price open above last day closing price on 10 minute chart and 10 minutes candle make green completely and meet criteria open = low. And second candle make green take entry in this candle and place stoploss at last day closing price above. Examine your risk reward yourself.

5. If you want to short sell than check if open =high. Stock trend is negative, and stock price is below from last day closing price. Than wait 10 minute candle make completely red, when another second candle make red take entry. Use stoploss at last day closing price.

6. For stoploss you can take 20% DATR of first 10 minute candle. When second candle make.

Things to Keep in Mind Before Opting for OHL Strategy

Trading volume : It is crucial for brokers to trade in shares that have high trading volume. Usually, stocks having high volume boost traders’ confidence.

First candle closng price :Individuals may consider taking a trade only if the closing price of the first candle is lower in comparison to that of the second candle.

Risk Reward Ratio-Tradersmight want to make sure that the risk-reward ratio is a minimum. Experts usually consider 1:2 as optimal. When taking a long call, traders might want to keep the immediate support level as stop loss. Conversely, when entering a short position, experts recommend keeping the immediate resistance as stop loss.

Range Breakout–Traders opting for this strategy might consider entering long or short positions following a range breakout.

How Can OHOL Strategy Determine the Type of Trading Session?

Generally, the trading volume in the market is high in the first 15 minutes, leading to more favourable trading opportunities. Such opportunities arise owing to the increased trading volume and price range expansion.

For instance, if the value is the same for open as well as low of the day, it serves as an indication that there’s excess demand in the market, which in turn leads to higher stock prices. That said, the reverse will hold true if the value is identical for open and high. In other words, there will be excess supply in the market. Accordingly, stock prices will be lower.

Intraday traders opting for the open high low strategy must give more emphasis on the opening trading session as that’s when they have high chances of maximising their returns.