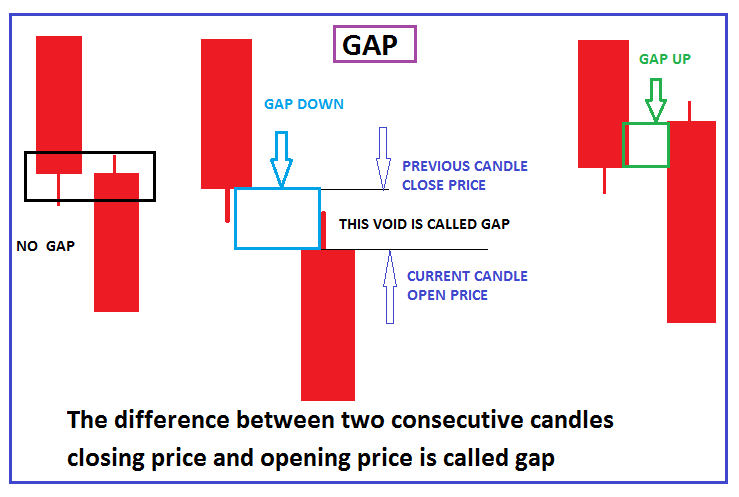

The difference between two consecutive candles’ closing and opening prices is called the gap. A gap occurs when prices skip between two trading periods, skipping over certain prices. A gap creates a void on a price chart. Price gaps are simply areas on the chart where no trading has occurred.

Price gaps are areas on a chart where the price of a stock (or another financial instrument) moves sharply up or down, with little or no trading in between. Traders focus on these gaps as they can indicate potential trading opportunities.

They provide insights into market sentiment, potential trading opportunities, and areas of support or resistance. A gap can signal the start of a new trend, a reversal of an existing trend, or a strong shift in market sentiment.

There are two types of gap in stock market. Inside gaps and Outside gaps.

Inside Gaps-.Inside gap created when stocks price open between previous day opening and closing price. Inside gaps used for short term trading by professionals or big players. Inside gaps are created in sideways market.

Inside gaps are gaps happening inside the prior day’s range.

Week market gap up

Strong market gap down

However, low volume warns you of a trap up-move (which is indicative of a lack of demand in the market) after a gap up resistance.

OUTSIDE GAP:

Why do Prices GAP up?

Gaps Greatest imbalance between demand and supply. The gap is up because of the aggressiveness of buyers. I mean, there are more buy orders at the open than are available on the prior day’s closing price. The gap is down because of the aggressiveness of the sellers. There are more sell orders at the open than willing demand at the prior day’s close. Therefore, gaps are almost always at price levels with a supply and demand imbalance at the open.

Gaps also occur due to the participant’s overnight sentiment or

big news.

Smart money is trying to avoid important support and resistance levels. If they are bullish, they will raise prices above the supply zone.

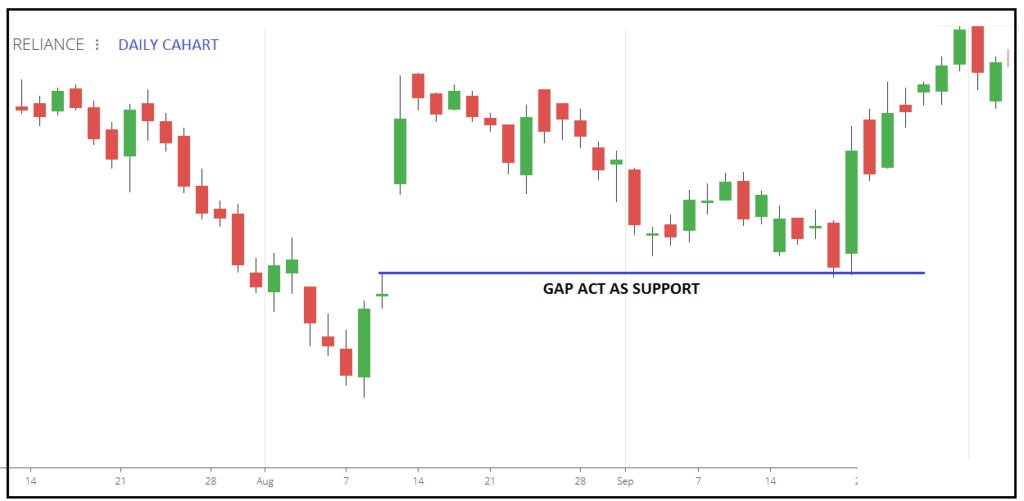

GAP acts as Support and Resistance:

Types of Gap Trading Strategy

Gaps are divided based on the context in which they appear.

Breakaway (or Breakout)

GapsRunaway (or Measuring)

GapsExhaustion Gaps

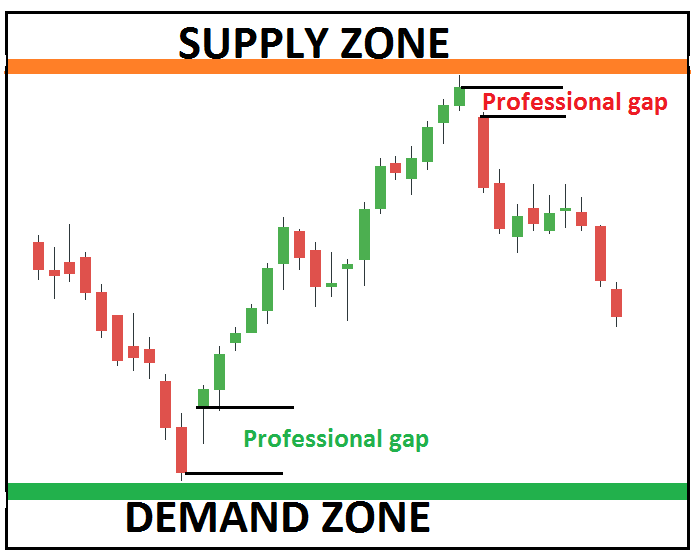

Professional gap

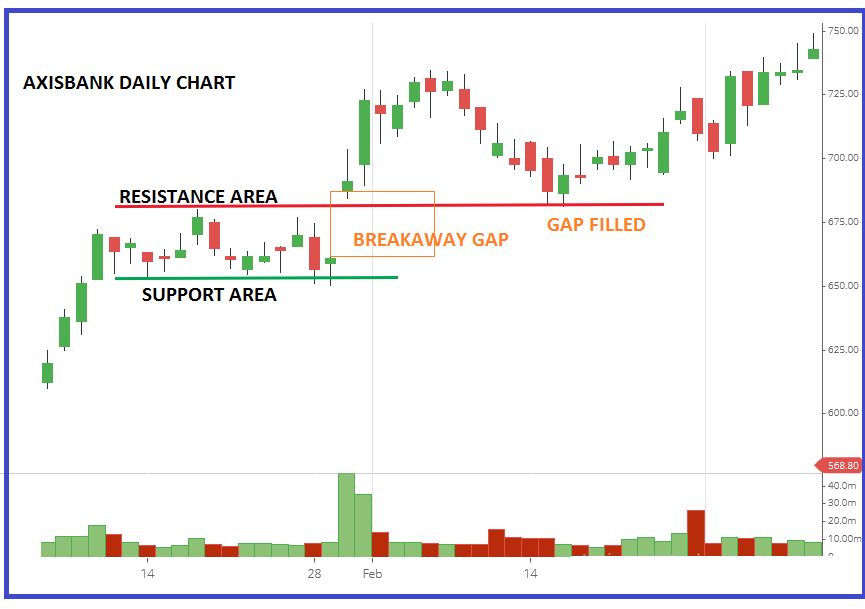

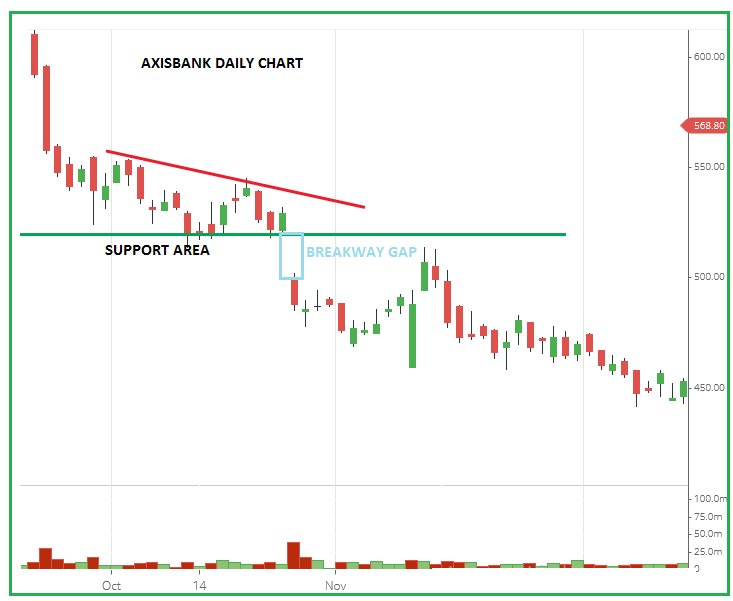

What is the breakaway GAP?

The breakaway gap means breaking the important support, resistance, or significant trend line. It generally appears after the completion of important patterns like price in the consolidation range or any continuation or reversal pattern. In maximum time, this gap does not fill quickly or on the same day. The most important volume should be high.

Why does the breakaway gap occur?

The smart money knows exactly where these resistance areas are. If the smart money is bullish and higher prices are anticipated, the smart money will certainly want a rally. The problem now is how to avoid the old resistance.

Gapping up through an old supply area as quickly as possible is an old and trusted method – avoiding resistance.

We now have a clear sign of strength. Smart money does not want to have to buy the stock at high prices. They have already bought their main holding at lower levels.

Smart money knows that a breakout above an old trading resistance area will create a new wave of buying. How?

Many traders who have shorted the market will now be forced to cover their poor positions by buying.

Many traders are looking for breakouts to buy.

All those traders who are not in the market may feel they are missing out and will be encouraged to start buying.

Here, you can see that prices have been quickly moved by smart money, whose opinion of the market is bullish. We know this because the volume has increased. It cannot be a trap-up move because the high volume supports it.

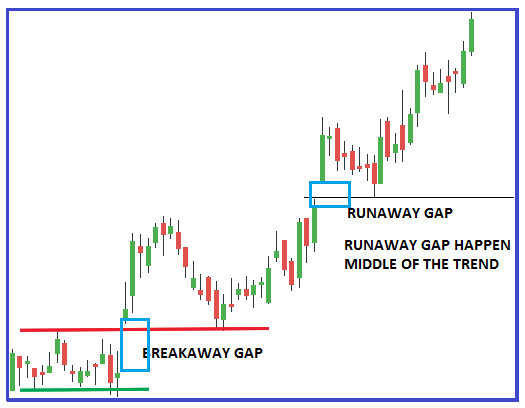

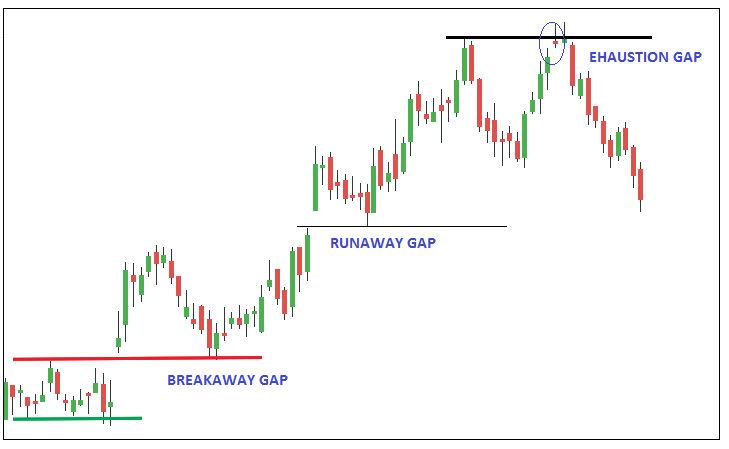

Runaway (or Measuring) Gap:

After the move has been underway for a while, prices will GAP somewhere around the middle of the move. This gap is called the runaway gap. An uptrend is a sign of continuation of a trend; a downtrend is a sign of continuation of the trend.

Exhaustion Gap:

You will find that weak gap-ups always gap up to resistance or gap down to support. This price action is usually designed to trap you into a potentially weak market and a poor trade, catching stop-losses on the short side and generally panicking traders to do the wrong thing.

The exhaustion gap occurs near the end of an uptrend. However, that upward gap quickly fades, and prices turn lower. When prices close under that last gap (exhaustion gap), it is usually a dead giveaway that the exhaustion gap has appeared. An exhaustion gap occurs with extremely high volume.

Professional GAP Trading Strategy:

These gaps appear at the beginning of the moves. Generally, it occurs in the supply or demand zone. (Gap up from demand zone and gap down from supply zone) when price approaches the quality supply and demand zone.